Fast-paced and rapidly growing, fintech is revolutionising how financial services serve and interact with consumers. In forging and evolving these responsive, customer-centric business models, task management, collaboration and process tracking solutions are key assets.

Here, we’ve explored the business process-related hurdles fintech companies often face, alongside sharing the remedies that monday.com has to offer players in this fast-moving field.

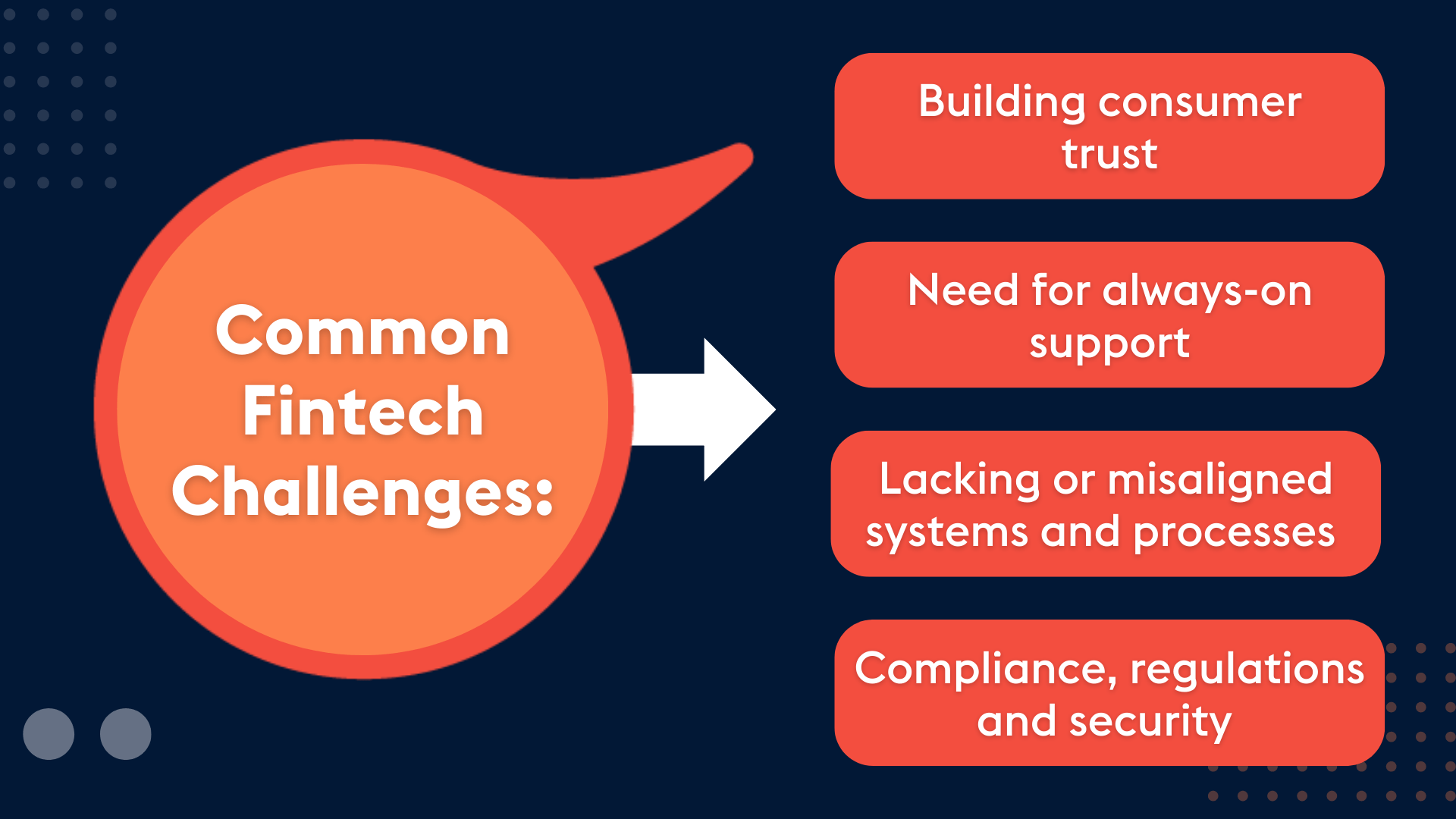

With managing consumers’ finances and sensitive data comes the need for stringent care. Customers rightly seek full assurance that their data is handled responsibly, alongside highly responsive product onboarding and customer care.

Offering cutting-edge technology requires equally brilliant customer service. Striking this balance enables fintech firms to create consistent, quality user experiences and scale consumer adoption. In the fast-paced fintech environment, constant and rapid adaptation is also key.

For smaller fintech companies, offering automated forms can alleviate the need to hire contact centre staff as customer enquiries grow. These forms can capture incoming requests, automatically assigning them to the right internal team. They can also speedily auto-prioritise requests, depending on their complexity, or even customer segmentation and value.

Relatively young fintech firms tend to avoid the burden of bulky legacy systems. Ambition and rapid growth, however, can mean projects accelerate before systems and processes catch up. Across project management, Customer Relationship Management (CRM), sales, marketing, and so on, you may not have the systems in place that you need to ensure organisation and accountability.

With your people multi-tasking across roles, teams and business areas, maintaining control is key. A platform that’s designed to combine all aspects of the business with a unified system, rather than disparate tools, will provide the stability, reliability and flexibility needed from early stages through to scalability.

Fintech firms, especially those with a banking focus, are no strangers to rules and regulations. Ideally, your digital solutions will have compliance baked in right from implementation, ensuring any adaptations and evolutions you roll out run no risk of breach. In addition, it’s wise to select software that’s primed to evolve as international regulations do.

Serve multiple business areas and use cases, all in one tool. Time-saving and cost-effective, your people won’t be jumping from platform to platform (perhaps losing cross-business insights along the way). Nor will you rapidly rack up investments in multiple stand-alone tools.

Eliminate spreadsheets: Evolve beyond Excel data-logging with monday.com’s added dynamism, adaptability, error-proofing and range of functionality.

Automate customer service: Field customer request influxes with automated forms, automatic query prioritisation and seamless assignment to internal teams. Add tailored notifications to track client status, too.

Easily track product and service development: Monitor all-important development progress via integrating Jira and other tools, facilitating reporting and project management.

Integrate sales and marketing: Connect HubSpot, Mailchimp and more to centralise, enhance and automate your sales and marketing operations. With in-depth Google Ads integration, you can now view data in monday.com to track campaign performance.

monday.com’s success has a lot to do with how easy it is to get up and running. We often find that, after a particular team introduces the platform to a company, it’s organically picked up by adjacent teams as they see its power first-hand.

Fundamentally, this stems from monday.com’s Work OS solution offering not just top-down value to a company, but tangible, day-to-day value to the individuals within the company. Led by its people, bottom-up.

In addition, monday.com’s inbuilt security facilitates usability and peace of mind:

✓ Fully compliant with the GDPR and US privacy requirements

✓ Compliance ensured as your business — and data retention — scale

✓ Rolling data encryption protects against hacks and breaches

✓ Advanced admin controls limit access to sensitive data

✓ Export restrictions help safeguard IP

We often speak with fintech clients who are still relatively small in size but headed for rapid expansion. Processes and workflows will naturally change with this growth, meaning a far-sighted approach to business systems design is key.

monday.com’s adaptability means processes you build initially can evolve as your team does; serving tens of employees now, then hundreds in a matter of months. Easy changes, customisation to shifting user requirements and extension to loop in more teams ensure you won’t have to hit pause and rethink your software as you grow. Just one straightforward implementation, designed to scale as you do.

Fundamentally, well-designed internal information-sharing enables all your teams to elevate performance.

Another of monday.com’s key plus points is easy reporting across multiple business areas. Forget extracting data from disparate — potentially outdated — files, collating it in yet more files, and building reports and decks manually. Linking in the right inputs to your monday.com dashboard enables generating complete reports with a few clicks, in real time.

Particularly from a senior management perspective, this is a key time-saver. We also see monday.com’s utility shine in the run-up to milestones such as funding rounds, IPOs and M&As. Companies at this stage are often relatively mature — yet the same can’t always be said for their systems, processes and data. Departmental silos and a lack of traceability can impede gathering the data needed to make a strong case to both private investors and the public market. The integration, transparency and audit-readiness monday.com offers are significant assets here, streamlining data presentation and building confidence.

With 70% of users in non-technical roles, integration, automation and customisation in monday.com are designed with user ease in mind. Minimal configuration means fintech engineering teams can focus their time and energy on building stand-out products, not integrating internal systems just so that your business areas can align.

Simple setup also enables users to experiment (with inbuilt data safeguards) with different ways of configuring business processes in monday.com. This is vital for finding the ideal fit for your teams, especially as your business grows.

Whether it’s an external payment provider or outsourced development, HR or marketing team, bringing them into monday.com as guest users is straightforward — and free! Enhance collaboration via native tools, chatting simultaneously in monday.com and using dynamic boards to collate information and eliminate long email trails. Guest access is easily configurable, ensuring data governance stays watertight.

The Provident CRM team has worked with hundreds of companies to optimise monday.com implementation for rapid results. We’re driven to share our cross-sector experience, and specific fintech expertise, to guide creating solid monday.com foundations. Priming your business process management to grow and evolve as your company does, and offering an external expert take on system and process design.

For more information, reach out to our team.

monday.com is the next evolution in communicating with your team and managing your projects. Learn more about it here, connect with our expert consultants, and get a free trial.